Is Military Exempt From Property Taxes In Texas . Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Property tax in texas is a locally assessed and. Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children.

from www.exemptform.com

Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Property tax in texas is a locally assessed and. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or.

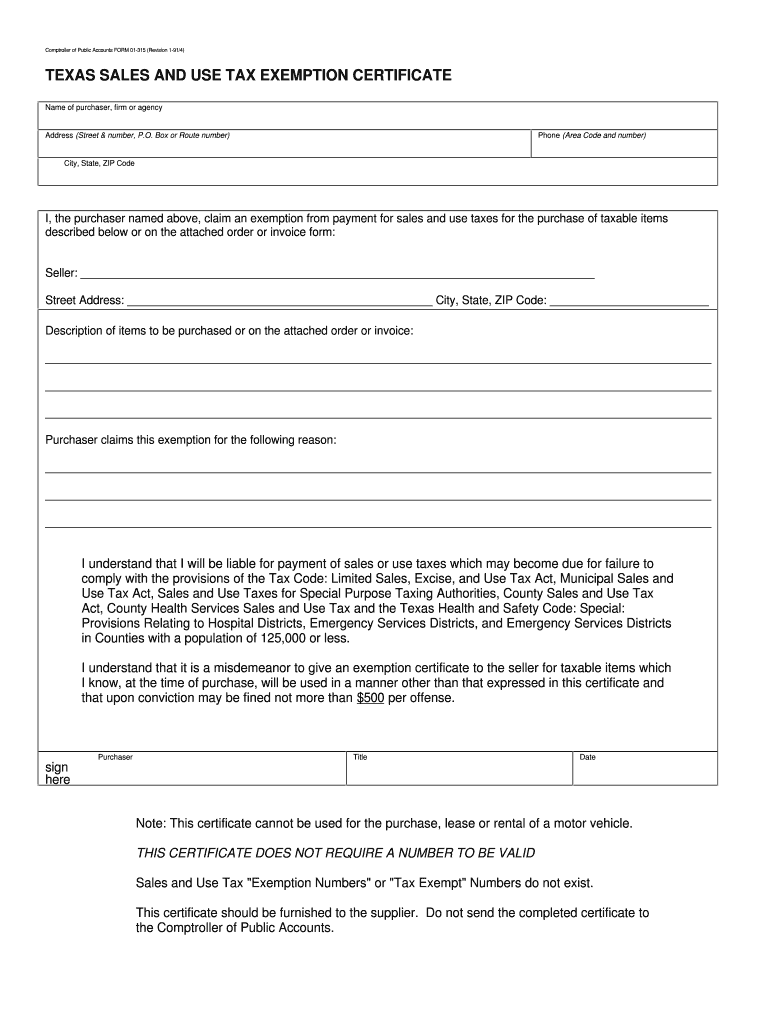

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF

Is Military Exempt From Property Taxes In Texas Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Property tax in texas is a locally assessed and. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or.

From www.exemptform.com

Tax Exemption Form For Veterans Is Military Exempt From Property Taxes In Texas Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Property tax. Is Military Exempt From Property Taxes In Texas.

From www.exemptform.com

Us Army Tax Exempt Form Is Military Exempt From Property Taxes In Texas Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Property tax in texas is a locally assessed and. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web in many states, there are tax. Is Military Exempt From Property Taxes In Texas.

From printableformsfree.com

Free Printable Texas Agricultural Or Timber Tax Exemption Form Is Military Exempt From Property Taxes In Texas Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Property tax in texas is a locally assessed and. Web the disabled veteran must be. Is Military Exempt From Property Taxes In Texas.

From studylib.net

TEXAS SALES AND USE TAX EXEMPTION CERTIFICATE Is Military Exempt From Property Taxes In Texas Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Property tax in texas is a locally assessed and. Web texas property tax exemption for partially disabled veterans and veterans over age 65:. Is Military Exempt From Property Taxes In Texas.

From www.pdffiller.com

Printable Texas Tax Exempt Form Fill Online, Printable, Fillable Is Military Exempt From Property Taxes In Texas Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web texas law provides partial exemptions for any property. Is Military Exempt From Property Taxes In Texas.

From www.exemptform.com

Agricultural Tax Exempt Form For Property Tax Is Military Exempt From Property Taxes In Texas Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Property tax in texas is a locally assessed and. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web tax code. Is Military Exempt From Property Taxes In Texas.

From tutore.org

Federal Tax Exempt Certificate Master of Documents Is Military Exempt From Property Taxes In Texas Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Property tax in texas is a locally assessed and. Web in many states, there are tax. Is Military Exempt From Property Taxes In Texas.

From decowindow.de

Texas tax exemption form In catalog files Is Military Exempt From Property Taxes In Texas Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Web tax code section 11.131. Is Military Exempt From Property Taxes In Texas.

From www.formsbank.com

Fillable Form Rpd41348 Military Spouse Withholding Tax Exemption Is Military Exempt From Property Taxes In Texas Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web. Is Military Exempt From Property Taxes In Texas.

From www.templateroller.com

Form TR601 Download Fillable PDF or Fill Online Military Personnel Is Military Exempt From Property Taxes In Texas Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web texas property tax exemption for partially disabled veterans and veterans over. Is Military Exempt From Property Taxes In Texas.

From www.exemptform.com

FREE 8 Sample Tax Exemption Forms In PDF MS Word Is Military Exempt From Property Taxes In Texas Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web in. Is Military Exempt From Property Taxes In Texas.

From www.signnow.com

Texas Hotel Tax Exempt Form Fill Out and Sign Printable PDF Template Is Military Exempt From Property Taxes In Texas Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property. Is Military Exempt From Property Taxes In Texas.

From www.uslegalforms.com

TX AP2281 2020 Fill out Tax Template Online US Legal Forms Is Military Exempt From Property Taxes In Texas Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web a disabled veteran. Is Military Exempt From Property Taxes In Texas.

From quizzschoolwaller.z21.web.core.windows.net

Non Profit Tax Exempt Letter Sample Is Military Exempt From Property Taxes In Texas Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web tax code section 11.131 requires. Is Military Exempt From Property Taxes In Texas.

From www.pdffiller.com

Rev 1220 As 9 08 I Fill Online, Printable, Fillable, Blank pdfFiller Is Military Exempt From Property Taxes In Texas Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web texas property tax exemption for partially disabled veterans and veterans over age 65: Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Web. Is Military Exempt From Property Taxes In Texas.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF Is Military Exempt From Property Taxes In Texas Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Web texas law provides partial exemptions for any property owned by disabled veterans or surviving spouses and surviving children. Property. Is Military Exempt From Property Taxes In Texas.

From www.exemptform.com

Military State Tax Exemption Form Is Military Exempt From Property Taxes In Texas Property tax in texas is a locally assessed and. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web texas law provides partial exemptions for. Is Military Exempt From Property Taxes In Texas.

From pafpi.org

Certificate of TAX Exemption PAFPI Is Military Exempt From Property Taxes In Texas Web in many states, there are tax breaks in place for former and current military personnel, disabled residents, and disabled veterans, and. Property tax in texas is a locally assessed and. Web a disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or. Web the disabled. Is Military Exempt From Property Taxes In Texas.